child care tax credit calculator

Former President Trump in his Tax Cuts and Jobs Act of 2017 increased the Child Tax Credit by 1000 per qualifying child. As of October 17 2022 you can no longer.

Maximizing The Higher Education Tax Credits Journal Of Accountancy

To reconcile advance payments on.

. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. If you get Tax-Free Childcare the government will. Have been a US.

The increased child tax credit is reduced by 50 for every 1000 income above the thresholds. 112500 if you are. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

You can get up to 500 every 3 months 2000 a year for each of your children to help with the costs of childcare. The tool below is to only be used to help. The Government of Canadas Affordability Plan includes an additional one-time GST credit payment.

Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the. Head of household return.

To qualify you must. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. This took the credit from 1000 per child under 17 to.

File with a Social Security Number. On their 2023 return assuming there are no changes to their marital or vision status. The Child and Dependent Care Tax Credit helps working families cover the high costs of child or dependent care so that parents are able to look for work and stay employed.

Tax credits calculator - GOVUK. You will get the additional one-time GST credit payment if you were entitled to. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

File a federal income tax return. The Child Tax Credit income limits are as follows. What You Should Know About the Regular Child Tax Credit from 2019 2021.

25900 1400 1400 1400. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The credit will be fully.

For instance if you. Under the Tax Cuts and Jobs Act TCJA the following child tax credit rules will take place between 2019 and. The new system is part of the American.

Starting July 15 families will start receiving monthly payments as high as 300 per child as part of the new expanded child tax credit. Once completed the tool lets families know if they qualify for advanced monthly payments of up to 300 per child under the age of 6 and 250 for each child aged 6 to 17. As a result their 2022 standard deduction is 30100.

Eligible households can receive up to 6728. Use the Child and Dependent Care Calculator - or CAREucator - tool below to see if you qualify for the Child and Dependent Care Credit. Have income between 1 57414.

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

Tax Credit Definition Types How To Claim

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

How Do I Calculate My Health Insurance Premium And Tax Credit Capstone Brokerage

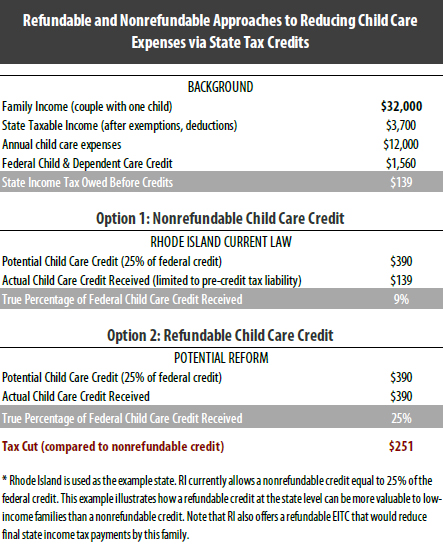

Reducing The Cost Of Child Care Through State Tax Codes In 2017 Itep

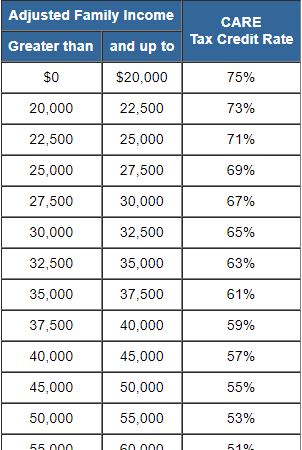

Taxtips Ca Ontario Refundable Care Childcare Credit

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

Try The Child Tax Credit Calculator For 2022 2023

Earned Income Tax Credit For 2020 Check Your Eligibility

Child Tax Credit Calculator 2021 How Much Moneylion

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

Child Tax Credit What Families Need To Know

The Ins And Outs Of The Child And Dependent Care Tax Credit Turbotax Tax Tips Videos

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post